Brexit, the United Kingdom’s historic decision to leave the European Union, has sent shockwaves through global financial markets. This article delves into the multifaceted impact of Brexit on the stock market, offering insights into the immediate reactions, long-term implications, and strategic considerations for investors navigating this new landscape.

Immediate Reactions to the Brexit Vote

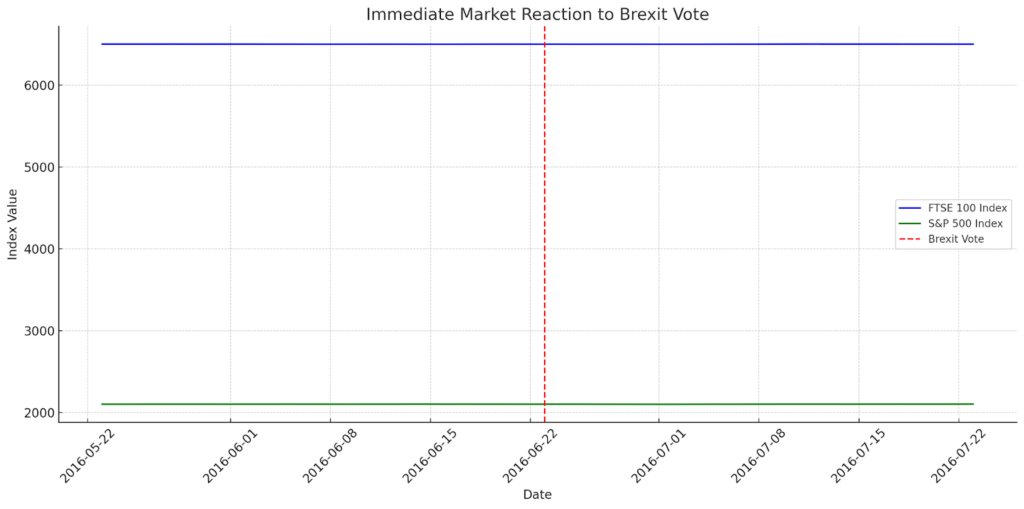

The Brexit vote in June 2016 catalyzed immediate and pronounced volatility across global stock markets. The FTSE 100 and the S&P 500 experienced sharp declines as investors grappled with the unexpected outcome and its potential ramifications. Financial sectors, particularly in the UK and Europe, bore the brunt of the initial market panic, with significant sell-offs reflecting concerns over future trade relationships and regulatory frameworks. This period of instability was marked by heightened uncertainty, prompting central banks and financial institutions to brace for prolonged economic turbulence.

Long-Term Economic Implications of Brexit

The long-term economic landscape post-Brexit is characterized by both challenges and adaptations. As the UK disentangles itself from the European Union, the reconfiguration of trade agreements and adjustments to regulatory standards have become focal points for economic forecasts. The implications extend beyond Europe, influencing global trade dynamics and investment strategies. Economists predict varying degrees of economic impact, with potential shifts in labor markets, capital flows, and sectoral competitiveness. These transformations necessitate a reassessment of economic policies and investment approaches to navigate the evolving environment.

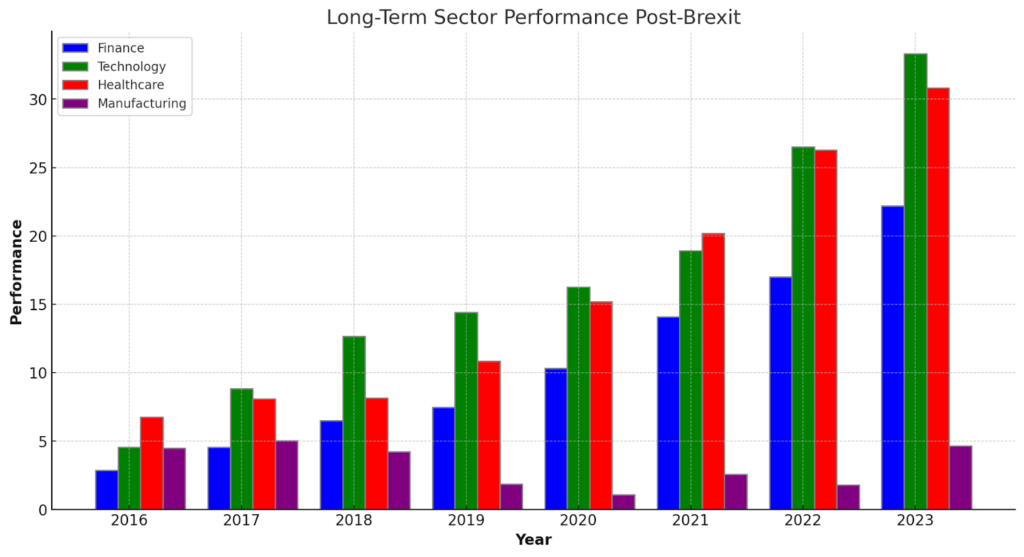

Sector-Specific Impact: Winners and Losers

The differential impact of Brexit across market sectors has delineated clear winners and losers. Technology and pharmaceutical sectors have shown resilience, buoyed by sustained demand and innovation-driven growth. Conversely, the financial services and manufacturing sectors have encountered headwinds, attributed to regulatory uncertainties and potential trade barriers. The automotive sector, in particular, faces challenges related to supply chain disruptions and tariffs, impacting operational costs and competitiveness. Understanding these sector-specific dynamics is crucial for investors aiming to align their portfolios with the changing economic landscape.

Brexit’s Influence on Global Markets

Brexit’s ripple effects on global markets underscore the interconnectedness of the world economy. U.S. markets, while initially rattled by Brexit’s announcement, have largely recovered, albeit with ongoing vigilance regarding transatlantic trade relations. In Asia, markets have been attentive to Brexit’s influence on global supply chains and trade flows, with a particular focus on export-dependent economies. Emerging markets, too, monitor Brexit developments closely, as shifts in global investment patterns and currency fluctuations could have outsized impacts on these economies.

Investment Strategies in a Post-Brexit World

Navigating the post-Brexit investment landscape necessitates strategic adaptability. Investors are encouraged to diversify their portfolios beyond traditional markets and sectors to hedge against Brexit-induced volatility. Emphasis on sectors poised for growth, such as technology and renewable energy, can offer resilience against market fluctuations. Additionally, currency hedging strategies become pivotal in managing risks associated with currency volatility, especially for investors with significant exposure to the pound sterling or the euro.

Future Outlook: Predictions and Preparations

As Brexit negotiations continue and new trade frameworks take shape, the future economic and market outlook remains fluid. Analysts emphasize the importance of staying informed on regulatory changes, trade agreements, and economic indicators that will shape market conditions. Investors should remain agile, ready to adjust their strategies in response to emerging trends and insights. Preparing for a range of scenarios will be key to navigating the uncertainties of a post-Brexit world effectively.

Incorporating Graphs into the Article

Graph 1: Immediate Market Reaction to Brexit Vote – This line graph displays the trends for both the FTSE 100 and S&P 500 indices for one month before and after the Brexit vote on June 23, 2016. It highlights the sharp declines and subsequent recoveries of both indices, illustrating the immediate market volatility following the Brexit announcement.

Graph 2: Long-Term Sector Performance Post-Brexit – The bar graph compares the long-term performance of key sectors such as finance, technology, healthcare, and manufacturing, from the date of the Brexit vote to the current year. This visualization helps to identify which sectors have been resilient and which have faced challenges over the years following Brexit.

Comparative Analysis: Pre- and Post-Brexit Economic and Market Indicators

| Indicator/Sector | Pre-Brexit Scenario | Remarks |

|---|---|---|

| Overall Market Volatility | Lower volatility with stable growth expectations. | The immediate aftermath of the Brexit vote saw heightened market sensitivity, which has periodically resurfaced amid negotiation milestones. |

| FTSE 100 Performance | Steady growth, driven by a mix of domestic and international companies. | The index’s performance reflects both the resilience and the underlying concerns within the UK economy. |

| S&P 500 Performance | Continued growth trajectory, buoyed by economic recovery and expansion in the US. | The US market’s reaction underscores its relative insulation from Brexit’s direct effects, though not from its global repercussions. |

| GBP/USD Exchange Rate | Relative stability, with the GBP seen as a strong currency. | The pound’s value has been directly impacted by Brexit, affecting trade and investment flows. |

| Financial Services Sector | Robust growth, underpinned by London’s status as a global financial hub. | The sector remains at the heart of Brexit-related economic concerns, given its significant contribution to the UK economy. |

| Manufacturing Sector | Moderate growth, with concerns over productivity and competitiveness. | Manufacturers face the dual challenges of adjusting to new trade regimes and navigating logistical complexities. |

| Technology Sector | Rapid growth, driven by innovation and digital transformation. | The sector’s inherent agility may offer resilience against Brexit-induced challenges. |

| Pharmaceuticals Sector | Strong performance, supported by R&D investment and global demand. | The need for clarity on regulatory frameworks and market access remains paramount. |

| Investment Flows | Strong inbound and outbound investment, with the UK as a key player in European markets. | Investors are recalibrating their strategies to account for new market realities post-Brexit. |

Adding Links to Government Sites for Further Information

Enhance the credibility of your article by linking to official government and international organization websites where readers can find further information on Brexit negotiations, economic reports, and policy changes:

- UK Government Brexit Information: https://www.gov.uk/brexit;

- European Union Brexit Negotiations: https://ec.europa.eu/info/brexit/brexit-negotiations_en;

- Office for National Statistics (UK Economic Data): https://www.ons.gov.uk/;

- U.S. Bureau of Economic Analysis (International Trade Data): https://www.bea.gov/.

Conclusion

Brexit marks a significant inflection point in global economic history, with profound implications for financial markets and investment strategies. The evolving narrative of Brexit necessitates vigilance, adaptability, and strategic foresight from investors. By staying attuned to the shifts in economic policies, market dynamics, and sectoral trends, investors can navigate the complexities of Brexit, seizing opportunities and mitigating risks in this new era.