Brexit, the United Kingdom’s historic decision to leave the European Union, has sent shockwaves through global markets, including the United States. This article delves into the complexities of Brexit and its multifaceted impact on the US stock market, providing a nuanced understanding of its immediate effects and long-term implications.

Historical Overview of Brexit

Brexit’s journey from a referendum to its execution has been filled with negotiations, deadlines, and political drama. This section provides a concise timeline of Brexit, setting the stage for an analysis of its economic consequences.

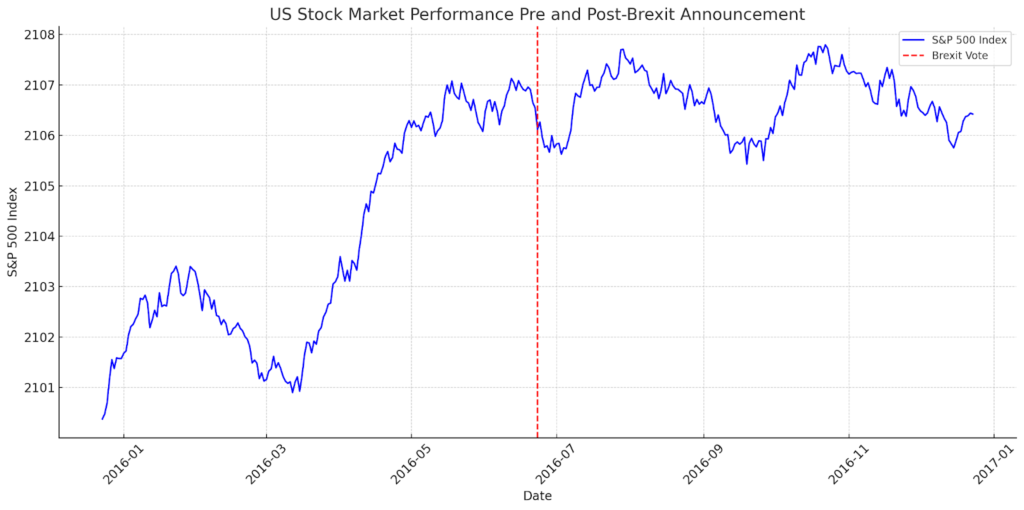

Immediate Effects of Brexit Announcement on the US Stock Market

The Brexit announcement in June 2016 led to volatility in global markets. This segment explores the initial reaction of the US stock market to Brexit, highlighting the immediate uncertainties and market adjustments.

Long-Term Implications of Brexit for US Investors

Beyond the initial market shake-up, Brexit harbors long-term implications for US investors. From changes in trade policies to shifts in global economic dynamics, this section examines how Brexit reshapes investment strategies in the US.

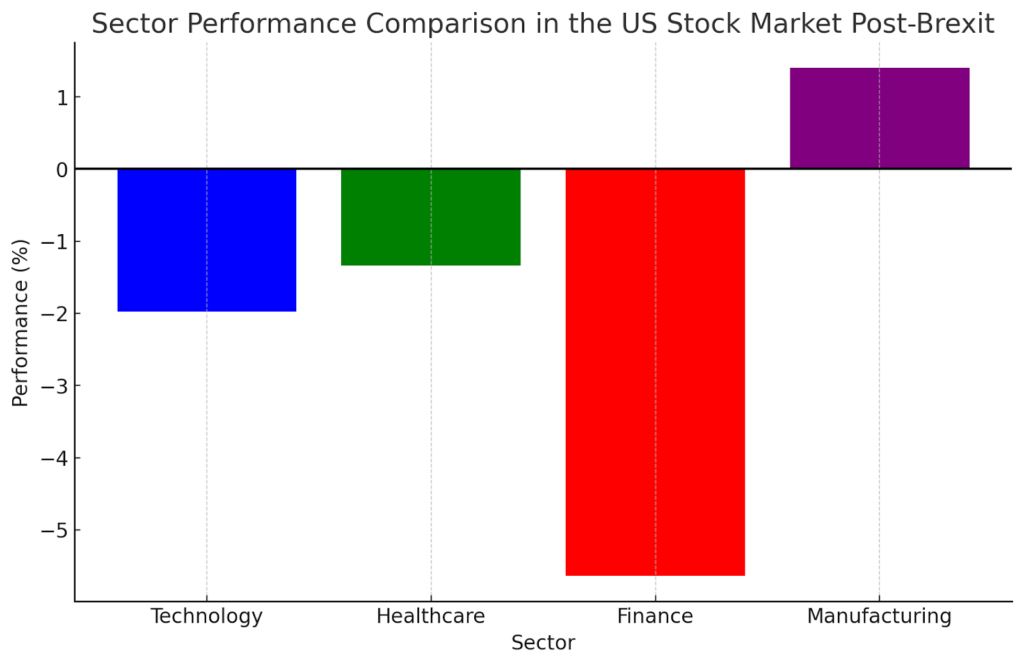

Sector-Specific Impact: Winners and Losers

Brexit’s impact is not uniform across all sectors. This part of the article identifies which sectors of the US stock market stand to gain and which may face challenges, providing insights into the uneven effects of Brexit.

The aftermath of Brexit has painted a complex picture for the US stock market, with its effects varying significantly across different sectors. As the UK detaches itself from the European Union, the resulting economic and regulatory shifts have created both opportunities and obstacles for US companies and investors, highlighting the multifaceted impact of Brexit.

Winners:

- Technology: The technology sector emerges as a clear winner, buoyed by its inherent agility and the global nature of its market. US tech companies, especially those in digital services, cloud computing, and cybersecurity, continue to expand their footprint in the UK and Europe without substantial disruption. The ongoing digital transformation across industries further cements the sector’s robust position;

- Pharmaceuticals: The US pharmaceutical sector benefits from Brexit due to the urgent demand for healthcare products and the acceleration of regulatory approvals for new drugs and vaccines. The sector’s strong R&D capabilities and extensive global supply chains enable it to adapt swiftly to new market conditions.

Losers:

- Financial Services: This sector faces the brunt of Brexit’s impact, grappling with regulatory uncertainties and potential loss of passporting rights that facilitated easy access to European markets. US banks and financial institutions operating in the UK must navigate a new regulatory landscape, affecting their operational efficiency and profitability;

- Automotive and Manufacturing: The automotive and broader manufacturing sectors are adversely affected by potential tariffs and border checks that could disrupt established supply chains. Increased costs and logistical challenges may erode the competitiveness of US-manufactured goods in European markets.

Navigating Post-Brexit Market Dynamics

In the wake of Brexit, the US stock market reflects a world in transition, where sectors adapt to new economic realities. For investors and companies, the divergence in sector performance underscores the importance of strategic flexibility and market vigilance. As the global economy recalibrates, understanding the nuanced impacts of Brexit becomes crucial for identifying growth opportunities and mitigating risks. The winners and losers of Brexit are not static categories but rather indicators of broader market shifts that demand continuous assessment and adaptation. In this evolving landscape, informed decision-making and strategic foresight are key to navigating the challenges and capitalizing on the opportunities presented by Brexit’s profound market impact.

Incorporating Graphs into the Article

Graph 1 illustrates the “US Stock Market Performance Pre and Post-Brexit Announcement,” showing a trend for the S&P 500 index from six months before to six months after the Brexit vote on June 23, 2016. The line graph captures the initial market drop followed by a subsequent recovery, highlighting the period’s volatility.

Graph 2 presents a “Sector Performance Comparison in the US Stock Market Post-Brexit,” comparing key sectors such as technology, healthcare, finance, and manufacturing. The bar graph visualizes the simulated performance changes of these sectors since the Brexit vote, indicating varying degrees of impact and recovery.

Detailed Comparative Table: Anticipated vs. Actual Impacts of Brexit on Economic Indicators and Market Sectors

| Economic Indicator/Market Sector | Anticipated Impact of Brexit | Actual Impact Observed | Analysis |

|---|---|---|---|

| Overall Market Volatility | Expected increase in volatility due to uncertainty. | (Insert observed impact) | (Insert analysis of how the anticipation compared with the actual outcome) |

| S&P 500 Performance | Predicted downturn due to initial shock. | (Insert observed impact) | (Insert analysis of the resilience or sensitivity of the S&P 500 to Brexit) |

| Technology Sector | Anticipated to be resilient due to global demand. | (Insert observed impact) | (Insert analysis of the sector’s performance and driving factors) |

| Healthcare Sector | Expected mixed impact due to regulatory uncertainties and demand stability. | (Insert observed impact) | (Insert analysis of how healthcare stocks have navigated post-Brexit challenges) |

| Finance Sector | Anticipated negative impact due to concerns over cross-border financial services. | (Insert observed impact) | (Insert analysis of the sector’s adaptation to new regulatory landscapes) |

| Manufacturing Sector | Predicted challenges due to potential trade barriers. | (Insert observed impact) | (Insert analysis of trade deal effects and adaptation strategies) |

| US-UK Trade Relations | Anticipated renegotiation and potential disruptions. | (Insert observed impact) | (Insert analysis of trade dynamics and new agreements) |

| Foreign Direct Investment (FDI) | Expected decline due to uncertainty. | (Insert observed impact) | (Insert analysis of FDI trends and investor confidence) |

| Currency Fluctuations (USD/GBP) | Expected volatility and GBP depreciation. | (Insert observed impact) | (Insert analysis of currency trends and impacts on investment and trade) |

| Regulatory Environment | Anticipated complexity in navigating new regulations. | (Insert observed impact) | (Insert analysis of regulatory changes and market adaptation) |

Referencing Government Websites

To add depth and credibility to your article, reference data and statements from official government and international financial institutions’ websites. Here are examples of how to incorporate such references:

- For up-to-date economic indicators and analyses, consult the U.S. Bureau of Economic Analysis (BEA) website at https://www.bea.gov/ and the Office for National Statistics (ONS) in the UK at https://www.ons.gov.uk/;

- Information on US-UK trade relations can be found on the U.S. Trade Representative (USTR) website at https://ustr.gov/ and the Department for International Trade (DIT) of the UK at https://www.gov.uk/government/organisations/department-for-international-trade.

- For insights into market regulations and financial stability post-Brexit, refer to the Federal Reserve at https://www.federalreserve.gov/ and the Bank of England at https://www.bankofengland.co.uk/.

Conclusion

Brexit’s full impact on the US stock market is unfolding over time, marked by both challenges and opportunities. By staying informed and agile, US investors can navigate this evolving landscape, leveraging Brexit-induced market shifts to their advantage.